“If you miss a payment on your insurance policy, the insurance company may cancel your coverage and charge you a late fee. “It’s important because it outlines what will happen if you don’t pay your premiums on time,” says Brian Greenberg, founder and president of Insurist, an insurance agency. Your insurance provider may even choose to write a policy with a future effective date on it, which can make it possible to secure your policy before you take over ownership of a house or car. Your insurance company may not offer insurance binders and the practice is becoming less common as insurance companies are now able to issue policies faster than in the past.

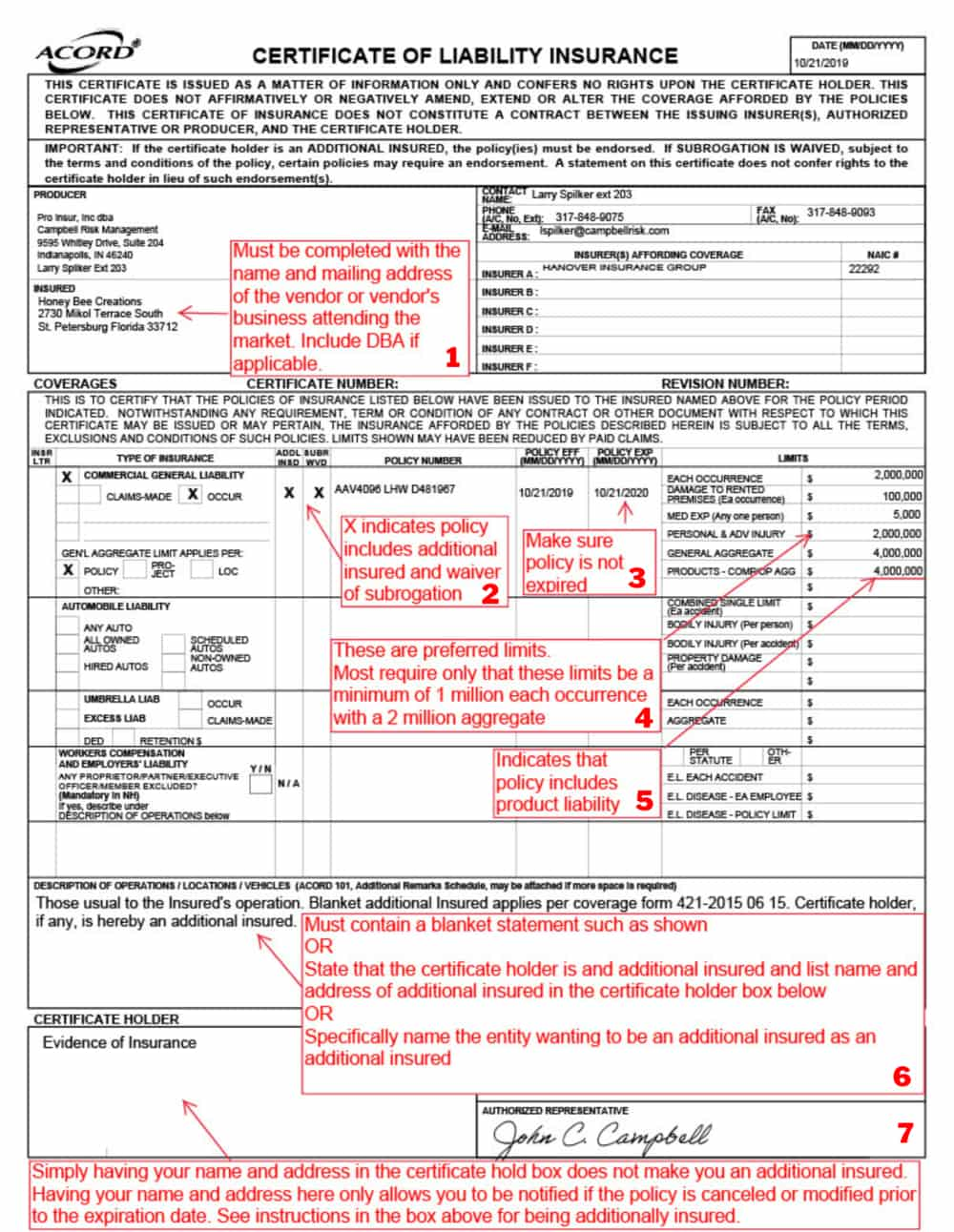

Once you have an insurance binder, you have evidence that you do in fact have coverage and can present it to a lender or anyone else who requires proof of insurance. Essentially, an insurance binder acts as a placeholder for a formal insurance policy during the underwriting process, which can last days or weeks. This is especially true if they took out a loan to make the purchase.Īn insurance binder can help bridge the gap between applying for a new insurance policy and officially having one. When someone buys a new car or a home, they generally need to have an insurance policy secured the day they assume ownership. When you need to prove insurance coverage, but are still waiting for your policy to be issued, an insurance binder can help bridge that gap.

While not always required, there are times when you may need to have auto insurance, homeowners insurance or other types of insurance in order to secure a loan or remain compliant with local laws. This is where insurance can step in to save the day. Life tends to throw curveballs our way more often than we’d like. Insurance binders don’t guarantee long term insurance coverage.You may need to provide a lender with an insurance binder in order to take possession of an asset used to secure the loan.An insurance binder acts as a placeholder for a formal insurance policy.

0 kommentar(er)

0 kommentar(er)